Look at the chart … The morning rally formed the A leg of the ABCD pattern. It then consolidated most of the day and formed the C leg. It broke out late afternoon, which was the entry signal, and rallied 11% from the breakout level. The ABCD pattern helps give traders a framework for where to risk and enter their trades.

BTC/USD Rebounding from $24k Support – FX Empire

BTC/USD Rebounding from $24k Support.

Posted: Mon, 13 Mar 2023 07:00:00 GMT [source]

The abcd pattern in trading is an intraday chart pattern that reflects the natural movement of the market. It consists of an initial leg up or leg down followed by a short consolidation https://trading-market.org/abcd-harmonic-pattern-in-forex/ and then another leg up or down in the direction of the original move. The ABCD trading pattern is a trend that prices can take in the market, observable on charts.

It is important to keep in mind that you shouldn’t use the pattern mentioned above in isolation when speculating on future price movements. It looks just like a hammer with a mallet on top and a handle beneath. When you spot this pattern toward the end of a downtrend, or an uptrend, it can often signal that the trend is ending.

If a stock is creating a “BC” leg into resistance at a moving average like the 20, it could signal an entry. The breakout would then become an add-on entry point, as seen in the example above. After a few tests of the 127.2% Fibonacci extension, GBP/USD price starts increasing. A couple of weeks afterwards, the Cable price reaches the minimum target of the pattern.

ABCD bull flag and bear flag strategy

The initial intrada swing from A to B consolidates briefly in B to C. Then, once the C to D portion of the move is complete, it often signals a bearish reversal. From A-B and C-D bulls are pushing the stock higher and higher with aggressive demand. It is also why the consolidation in C produces a higher low. ABCD pattern trading is something every day trader needs to have in their arsenal. And it is far and away the most consistent pattern because it’s rooted in market fundamentals.

It gives traders an idea of where the market might reverse and, when combined with other forms of technical analysis, it may be a great addition to your trading arsenal. In terms of theory, this study adds to the growing body of literature on technical analysis and the use of chart patterns in Forex trading. Further research is needed to explore the effectiveness of the ABCD pattern in different market conditions and timeframes. Additionally, future studies could investigate the potential impact of news events and other external factors on the validity of the pattern.

Harmonic Patterns in the Currency Markets – Investopedia

Harmonic Patterns in the Currency Markets.

Posted: Sat, 25 Mar 2017 20:13:28 GMT [source]

The three-drive pattern is a lot like the ABCD pattern except that it has three legs (now known as drives) and two corrections or retracements. Firstly, ideally you want the time and length of AB and CD to be roughly equal (unless you have found an ABCD extension). In strongly trending markets, BC may only be 38.2% or 50% of AB. In a ‘classic’ ABCD, the BC line should be 61.8% or 78.6% of AB. So, if you use your Fibonacci retracement tool on the initial move from A to B, BC should end at the 61.8 or 78.6 level. If you think you’ve spotted an ABCD, the next step is to use Fibonacci ratios to check that it is valid.

Why Trade Shares with FXCM?

One common approach is to analyse historical price data from a particular currency pair using charting software. Traders can then use various technical analysis tools, such as Fibonacci retracements and moving averages, to identify potential ABCD patterns. The validity of the pattern can then be confirmed using statistical analysis.

The position is then accumulated if the bullish break develops as expected. With the ABCD pattern, false buy/sell signals are possible. A prudent use of leverage is advised when trading ABCD trend-following or reversal strategies.

If that’s the case, traders can use the sequence to predict when to enter or exit their positions by charting the value of D using the Fibonacci sequence. In this particular case if you had decided to stay in the trade for further profit, your decision would have been rewarded. On the way up, the price creates only higher bottoms, and doesn’t test any critical support areas, which bolsters our long position.

What Is the ABCD Pattern?

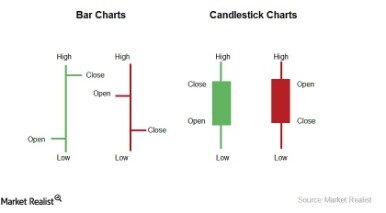

The ABCD pattern is a visual, geometric chart pattern comprised of three consecutive price swings. It looks like a diagonal lightning bolt and can indicate an upcoming trading opportunity. Unlock our free video lessons and you will learn the exact chart patterns you need to know to find opportunities in the markets. Using the ABCD pattern to identify potential trend reversals. It is worth noting that traders face the risk of losing money on every single trade. Even the most successful traders lose money from time to time.

- Importantly, orders will be carried out once your loss reaches a certain level.

- While this isn’t an exact science, we recommend that you look through the trading simulator for different examples of abcd patterns and measure them to find your best fit.

- Directional moves are commonly referred to as “legs” and may be quantified on any duration chart, from one minute to yearly.

- StocksToTrade in no way warrants the solvency, financial condition, or investment advisability ofany of the securities mentioned in communications or websites.

Interestingly, trend traders will utilize indicators throughout the trend in order to locate potential retracements, which are temporary moves against the prevailing trend. After putting a stock on your watchlist that is making new highs on good volume, you’ll want to monitor it for pullbacks. Depending on which strategy for the ABCD pattern that you employ, you’ll want to watch it closely.

The pattern is complete when the price retraces from point D. Once we realize the price bounce off the 127.2% extension level, we can see price starts its upward movement. A few weeks after the long signal on the chart, the price action completes the minimum target of the bullish ABCD pattern. Are you looking to improve your trading strategy and technical analysis skills? This tool may help you identify potential reversals and decide when to enter a trade. Keep reading to learn more about the ABCD pattern and how to apply it to your own trading strategy.

Ascending Triangle Chart Pattern: Definition, How to Trade it

Also the harmonic

pattern ends at a retracement of 0.786 from the point where the overall pattern

begins. Bullish patterns help identify higher probability

opportunities to buy or go “long.” Bearish patterns help signal

opportunities to “short,” or sell. Many times ABCD patterns are not perfectly symmetrical or even close to. But usually the CD leg is longer – these are called ABCD extensions. The Kicker candlestick pattern appears during an uptrend or downtrend and signals a sharp market reversal.

In addition,StocksToTrade accepts no liability whatsoever for any direct or consequential loss arising from any useof this information. Should seek the advice of a qualified securities professional before making any investment,and investigate and fully understand any and all risks before investing. As with any pattern, only trade the best setups and at the right time of day. You may want to buy every ABCD breakout, but know that if the midday pullback is large, the risk/reward at the breakout level will be poor. If a stock’s very choppy or putting in more volume than the A leg during this period, it’s best to skip it.

It is vital to create rules and follow the rules when the psychological crunch comes. Your guidelines must be based on your risk-reward tolerance. Fortunately or unfortunately, emotions play an important role in almost every decision. So, it is very important to understand how emotions influence our decisions.

The sequence of events follows a particular harmonic pattern in market movement that can be helpful to traders in attempting to predict future price swings. There are other variations for trading the abcd pattern as well. Many intraday scalp traders look to trade the BC pullback as an opportunity to join the AB/CD trend. In other words, if the stock is trending upward on the AB leg, some traders will anticipate the BCD portion of the move by going long and buying the breakout. The harmonic pattern of movement can apply in different market conditions that follow both bullish and bearish swings. With us, you can use the ABCD pattern trading to speculate on the movement of different foreign exchange (forex) pairs by selling one currency while simultaneously buying another.

The price is reversed again, creating a brand new bearish ABCD point once the chart is formed in the ABCD pattern. Once the price swing reaches point D,

it drops down further as a decrease in the price caused due to the reversal, once again. HowToTrade.com takes no responsibility for loss incurred as a result of the content provided inside our Trading Room. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade.

On July 6, 2021, Newegg announced it would make rare computer parts available to the public through a lottery system. The company also launched a service to pre-build customers’ computers before they’re shipped. I know I say this time and time again, but you must have all your ducks in a row before jumping into a trade.

Lastly, you’ll start your third and final trendline from the high of C to the low of D. But ABCD pattern trading is one of the most trusted indicators for decision-making because it’s the product of market fundamentals in action. This time, we have the 4-hour USD/JPY Forex pair on the chart.

Cart is empty

Cart is empty